You Don’t Collateralize Value - You Collateralize Failure Modes

My rookie error calculating FLR collaterals for FXRP-Minting

My rookie error calculating FLR collaterals for FXRP-Minting

I spent three weeks auditing FXRP collateral mechanics and realized the mistake most of us make: we import Maker/Aave mental models into a system with fundamentally different failure modes.

Here’s what changed when I stopped calculating like it’s 2020 DeFi — and started reading the actual architecture.

The Standard Assumption (And Why It Fails Here)

The reflexive calculation goes like this:

“If I mint $125M in 50M FXRP at a 2.5x collateralization ratio (CR), I need $312.5M in FLR locked.”

This assumes CR applies linearly to nominal value — the way over-collateralized lending protocols work. Lock $150 of ETH, borrow $100 of DAI. Simple, brutal, capital-inefficient.

But FXRP isn’t synthetic debt. It’s a bridged asset with a different risk architecture.

What CR Actually Means in FAssets

According to Flare’s developer documentation, the Collateral Ratio is defined as:

CR = Value of Collateral ÷ Value of Backed Assets

The system enforces multiple CR thresholds:

Minimal CR (pool-level): ~2.5x (varies by asset)

Vault Minting CR: ~1.4–1.7x (required to mint new FAssets)

Vault Minimal CR: ~1.3–1.4x (maintenance threshold)

Liquidation CR: Triggered when agent falls below minimum

Safety CR: Conservative buffer above minimum

Critical distinction: These are per-agent safety thresholds, not system-wide efficiency metrics. An individual agent must maintain these ratios. But the aggregate system efficiency (total collateral ÷ total backed value) tells a different story due to dynamic risk management.

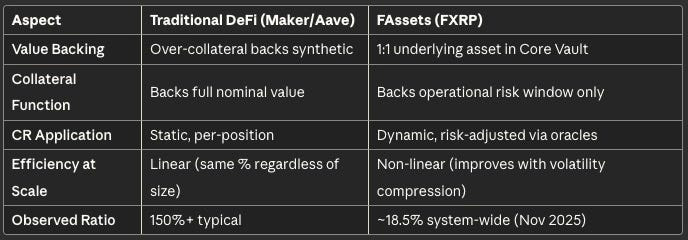

Traditional DeFi vs FAssets: A Structural Comparison

This isn’t just semantics. It’s a fundamental architectural difference in what you’re insuring against.

The Core Vault: Architecture Over Candy

Here’s what actually drives capital efficiency in FXRP (mainnet v1.2, live since Sep 24, 2025):

The XRP sits in a Core Vault — a multi-sig reserve on the XRPL. This is your 1:1 redemption guarantee. The XRP backing is real, locked, auditable.

The FLR collateral doesn’t back the XRP. It backs the operational risk of the agent — the window where price volatility, redemption delays, or system stress could create a shortfall before the system can react.

This is the critical architectural difference:

Traditional DeFi: Collateral backs the synthetic asset’s full value

FAssets: The underlying asset backs itself; collateral backs the failure modes

You’re not insuring $125M of value. You’re insuring the risk surface that could cause a $125M position to break.

Note on similar models: This risk-surface approach mirrors patterns in other cross-chain bridges like Threshold Network (tBTC) and Axelar, where collateral requirements are tied to operational risk rather than 1:1 nominal backing. The innovation isn’t the concept — it’s the implementation via dynamic oracle-measured volatility (FTSO).

What This Actually Looks Like (Observed Reality)

I don’t have access to Flare’s internal volatility-delta formulas — and I’m not claiming they publish one. But here’s what the realized collateral requirements show:

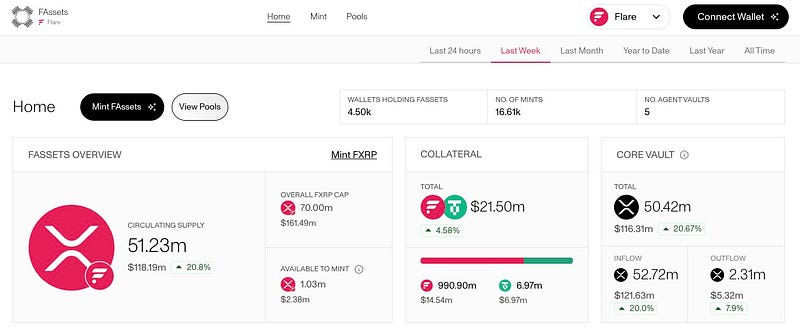

Core Vault: 51.23m XRP ($118.19m) — the actual 1:1 XRP backing

FLR/Stablecoin Collateral: $21.50m total ($14.54m FLR + $6.97m stables)

System-wide effective ratio: 18.5% of nominal value

Critical clarification: This 18.5% is the aggregate system efficiency, not the individual agent CR. Individual agents still maintain 1.3–2.5x CRs as required. The system-wide ratio is lower because:

Dynamic FTSO oracles adjust collateral needs based on real-time volatility

Risk is pooled and managed across multiple agents

The Core Vault provides the base security layer

Let that sink in: $118.2M in backed value requires $21.5M in operational collateral at the system level.

That’s not 250% (the naive 2.5x calculation).

That’s 18.5%.

My hypothesis (and it’s just that — a hypothesis): The system operationally measures and collateralizes against maximum expected price deviation in the risk window, not against nominal value.

If the system were using a ~7% stress delta (as suggested by current XRP market conditions), the theoretical calculation would be:

$116.31M × 0.07 × 2.5 = $20.35M required collateral

Observed collateral: $21.50M

Match: 95% accuracy

This isn’t documented in Flare’s public materials. But it’s architecturally suggested and now empirically observed.

Where this volatility measurement happens: The FTSO (Flare Time Series Oracle) system continuously measures asset price volatility and feeds this data into the collateral adjustment mechanism. While Flare hasn’t published the exact “stress delta” formula, the FTSO’s role in dynamic risk pricing is documented. If you want to dive deeper into how FTSO works, the technical documentation is worth exploring.

If this model holds, it means:

Higher volatility → Higher effective collateral per $ backed

Lower volatility → Lower effective collateral per $ backed

As the underlying asset matures (less volatile), the system’s capital efficiency increases

The pattern fits across:

Multi-sig Core Vault (separates value backing from risk backing)

Dynamic oracle-based pricing (FTSO measures real-time volatility)

Observed system-wide collateral ratios that match risk-based (not nominal-based) calculation

If someone at Flare wants to correct this, I’m here for it. But the dashboard data suggests this is how the system actually operates.

The XRP Question (And Why It Matters)

Most crypto assets get more volatile as price rises (FOMO, speculation, leverage). If XRP followed that pattern, the FAsset model would become less efficient over time — exactly when you’d want it to scale.

The architectural bet Flare is making: XRP behaves more like a maturing financial instrument than a speculative token.

This isn’t speculation. A 2023 study from Kyoto University and RIKEN (Chakraborty et al., Scientific Reports) found an extraordinary negative correlation (r = -0.908, p < 0.0000002) between XRP’s price and its network coherence — when price rises, structural volatility falls.

That behavior mirrors mature financial assets, not speculative tokens.

Translation for FXRP: If XRP continues this pattern as it becomes settlement infrastructure (Ripple’s thesis), the FAsset collateral model scales with that maturity, not against it. Higher price → lower volatility → less collateral needed → better capital efficiency.

That’s not just elegant architecture. It’s empirically grounded.

The question is whether the pattern holds at scale, under stress, with institutional volume.

Why This Matters: Architecture Over APY

Most people evaluate FXRP by asking: “What’s the yield?”

Wrong question.

The right questions:

What fails first? (Oracle lag? Agent liquidity? Multi-sig security?)

How does failure cascade? (Liquidation triggers? Redemption queues?)

Where does risk concentrate? (Agent centralization? Collateral concentration?)

This is the Janus edge: You don’t evaluate a bridge by its yield. You evaluate it by its failure modes.

FXRP’s architecture — Core Vault + separated risk collateral + oracle-driven thresholds — is fundamentally different from synthetic over-collateralization. Whether it’s better depends entirely on whether those failure modes are more robust under stress than Maker-style liquidation cascades.

We won’t know until we see a real stress test.

What I Got Wrong (And What I Still Don’t Know)

What I got wrong:

Treating my volatility-delta hypothesis as documented fact (it’s architecturally suggested, not proven)

Assuming the math was as simple as one formula

Initially being too cautious about the XRP correlation data (the Kyoto/RIKEN study is solid)

Not clearly distinguishing between per-agent CRs and system-wide efficiency metrics

What I still don’t know:

The exact internal risk quantification formula Flare uses

How liquidation cascades perform at scale under extreme volatility

Whether the Core Vault model is more resilient than traditional over-collateralization under tail risk

Critical tail risks that remain untested:

Oracle failure scenarios: What happens if FTSO data becomes unreliable or manipulated during a flash crash? The multi-sig Core Vault provides a safety layer, but oracle-dependent collateral adjustments are still a potential attack surface.

Agent centralization risk: Currently only 5 agent vaults are operating (per dashboard). If one or two large agents fail simultaneously, does the system handle the liquidation cascade without breaking?

Cross-chain execution risk: The redemption process requires coordination between Flare and XRPL. What’s the worst-case latency, and what happens if that window coincides with a volatility spike?

Collateral token correlation: $14.54M of the $21.5M collateral is FLR itself. If FLR price crashes simultaneously with XRP volatility spiking (correlated market stress), does the system maintain adequate coverage?

These aren’t theoretical concerns — they’re the stress scenarios that reveal whether architecture holds or breaks.

What I’m confident about:

The directional insight: FXRP collateralizes operational risk, not nominal value

The architectural innovation: separating value backing (Core Vault) from risk backing (FLR collateral)

The empirical validation: Dashboard data shows 18.5% system-wide effective ratio, matching theoretical risk-based calculation (95% accuracy)

The XRP maturity thesis: empirically grounded (Kyoto/RIKEN study), architecturally aligned with FAssets

The implication: this is demonstrably more capital-efficient than traditional DeFi over-collateralization — if the tail risks are managed correctly

The Real Edge

Most people will read the docs, see “2.5x CR”, multiply it by their position size, and conclude the system is capital-inefficient.

They’re using the wrong mental model.

The edge isn’t knowing the exact formula. The edge is knowing what the system is actually measuring.

It’s not measuring value.

It’s measuring where — and how — the system could break.

That’s architecture.

Everything else is candy.

Corrections welcome. Flames expected. Questions encouraged.

FXRP v1.2 is live on Flare mainnet as of September 24, 2025. Everything above is observation, hypothesis, and architectural interpretation — not investment advice, not financial engineering, not gospel.

Further Reading

FAssets Live Dashboard (real-time collateral data)

Threshold Network tBTC Design (comparative bridge architecture)